A recent CIBC survey found the pandemic has affected Canadians and their plans for retirement.

More than 3,000 people were polled in August.

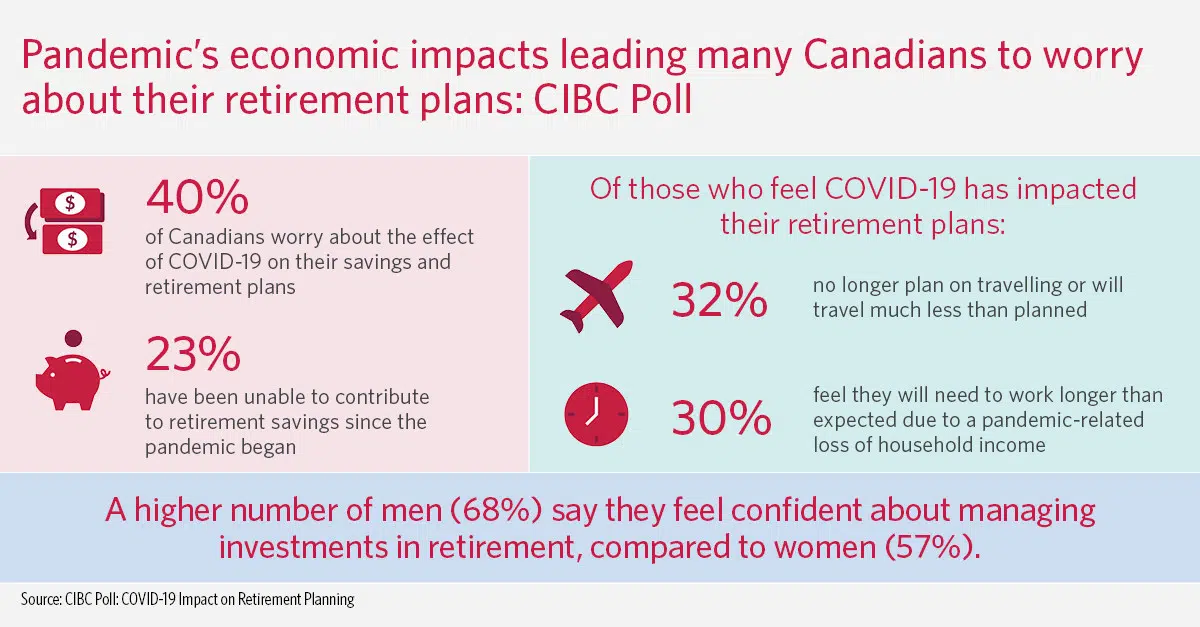

Forty per cent said they are worried about the effect COVID-19 will have on their savings.

Twenty-three per cent said they have been unable to contribute to their retirement funds since the pandemic began.

Many of the Canadians asked also felt they will need to work longer than expected, because of a loss of retirement savings, or because they feel the cost of retiring has increased due to COVID-19.

The survey also found:

- 26 per cent of those between the ages of 34-55 and 20 per cent of Canadians over the age of 55 have been unable to contribute to retirement savings since the pandemic began

- Of those who feel COVID-19 has affected their retirement plans, 24 per cent say the pandemic has made them realize they can live with less and will significantly reduce their discretionary spending in the long-term

- Lessons Canadians say they’ve learned during the pandemic include: there’s a need to pay more attention to personal finances (20 per cent); not to panic when markets get volatile (21 per cent); and it’s important to save for retirement/their future (19 per cent)

To help Canadians with retirement planning amidst the pandemic, CIBC is hosting a free webinar (in English and French) featuring a number of financial experts on November 3rd, 2020. For more information and to register, visit the website here.