Common Council got a look at the proposed 2020 budget on Wednesday night, after three consecutive nights of meetings. (Danielle McCreadie)

Saint John residents will see no change to their tax rate in 2020.

The city’s $166.5-million operating budget—an increase of 3 per cent over last year’s budget—includes a tax rate of 1.785, which has remained unchanged for the past 12 years.

One of the reasons the city can keep a consistent tax rate this year despite major financial struggles is a growing tax base, which has exceeded targets of 1.5 per cent for the past two years.

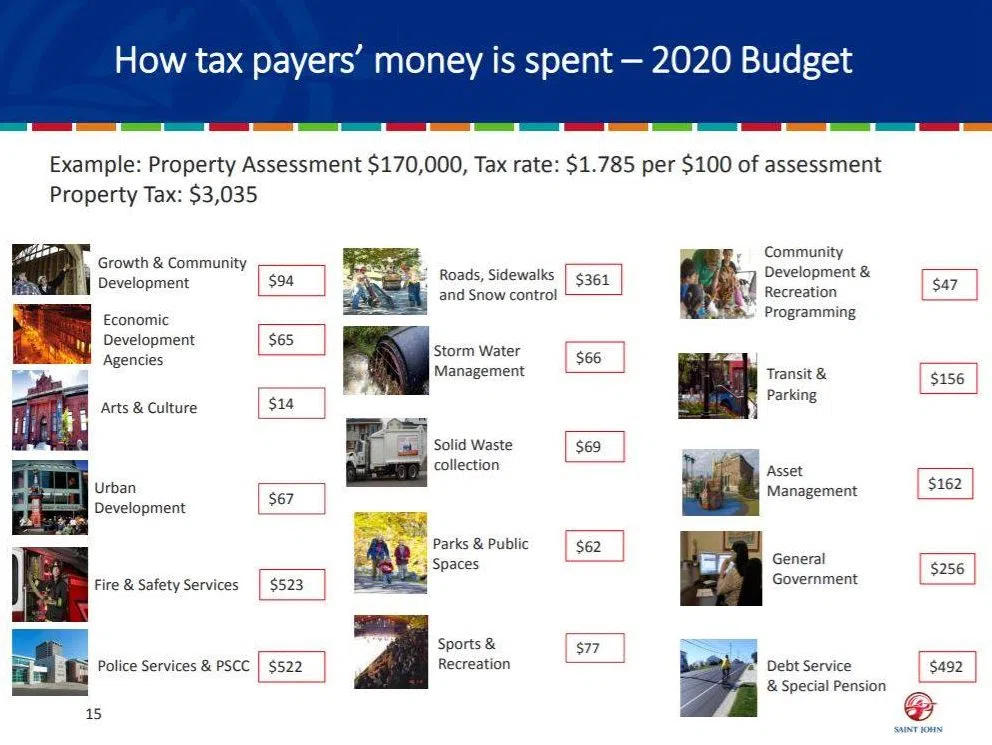

The city lays out an example: if your property is worth $170,000, and you pay $1.785 per $100 of assessment, your property tax will be $3,035 annually.

The city also breaks down where exactly that $3,035 goes. The top two things property taxes fund is police ($522) and fire ($523), followed by debt management and special pensions ($492), and road/sidewalk maintenance and snow removal ($361).

At the bottom of the list is arts and culture ($14).

A look at where your property taxes go. (City of Saint John)

In 2020, costs for police will stay relatively the same, while fire’s budget will increase by around $200,000.

Mayor Don Darling says the costs for police and fire are rising at an unsustainable rate across the region.

“Do we value our first responders? Do we respect our first responders? Absolutely we do. But that’s separate from the cost challenges that we have. We’ve seen wage escalation far above, double the rate of inflation over the last 15 years,” he said.

Wage escalation has resulted in $100-million in costs for the city. Had a wage escalation policy been in place, the city would have saved $57-million.

The budget for roads and sidewalks is also increasing. Street surface maintenance will see a jump of around $1 million, while sidewalk maintenance will increase by $90,000.

The total budget has increased by $6.2-million.

The city’s debt has continued to decrease, thanks to the fiscally responsible decision of the Finance Committee to adopt a Debt Management Policy.

The policy will ensure debt levels continue to decrease, with a 25 per cent reduction by 2030.

Since 2014, the debt has been reduced by 15 per cent. By the end of next year, city staff expect it to be below $100-million.

The 2020 budget will be approved and adopted on December 16th.

Looking Ahead To 2021

Mayor Darling says 2020 will be a “transition year” for the city, as it prepares to tackle a looming structural deficit through service cuts and sustainability initiatives.

“We don’t know yet all of those decisions that we’re going to make. We have made one major decision and that is 50 per cent of our deficit will be addressed through our workforce (savings of $5.5-million annually). By this time next year, we have to have a balanced budget going into 2021,” he said.

When Darling was asked if he was confident the city would be able to balance its budget for 2021, he says they have no choice.

“We’ve run out of money, and we have to balance our budget. We’re the only level of government that has to balance a budget, and we’re going to do it. We are restructuring, we are changing, we are addressing our issues, and we have a lot of work to do to balance our budget over the next 365 days,” he said.

“It’s a historic time for the city of saint john. these decisions are challenging, but I have been advocating for this type of restructuring and addressing our issues very close to the first day as Mayor.”

Restructuring decisions will continue to be made until March of 2020, when the province will re-evaluate Saint John’s finances and its adherence to its sustainability plan.

“Put your seat belts on the next three months around city hall here are going to be very busy,” said Darling.

Working With The Province

The city is only using around $8 million out of the $10 million from the province’s New Deal funds in 2020 and would have around $6.7 million left over when the deal ends next year.

Some councillors wanted to see all the money used, while others saw it as disciplined to set some aside.

“We have a responsibility within the agreement to use the dollars in very specific ways,” said Mayor Don Darling.

“With the dollars that we prudently have not spent, is there some opportunity to help us with our restructuring costs? From my perspective, that should only be for the structural reset of our operations, not for special projects.”

The city has sent a letter to the province asking if they can potentially use the extra $6.7 million for restructuring costs, but they haven’t gotten a response yet.

When Local Government Minister Jeff Carr was asked at a recent media briefing, he said: “maybe.”

The city is waiting for several legislative reforms to help get its finances back on track, including regional cost-sharing, property tax reform, heavy industry tax reform.

“At the end of the day, when the tax money rolls in, the province is keeping 45 per cent of commercial and industry taxes,” explains Councillor Donna Reardon. “That’s where the real problem is. We need those tax dollars.”